VEHICLE AND EQUIPMENT FINANCE AT THE SPEED OF BUSINESS!

FAST, EASY &

FLEXIBLE

Get approved in 24–48 hours. Compare 40+ commercial lenders.

No guess work. No wasted time. No pushy salespeople.

Fast approvals in 24–48 hours

Access to 40+ commercial & consumer lenders

Low-doc options for ABN holders

Finance available for cars, utes, trucks & all types of equipment

Dedicated finance specialist from application to settlement

🔒 Secure & confidential application

⭐ 1,200+ approved business owners

⚡ Lightning-fast turnaround

Why Australian Businesses trust

Lyft Money

Trusted by 1,200+ Australian businesses for fast, effortless vehicle & equipment finance.

No BS. No delays. No markups. Just quick approvals and sharp commercial rates.

Rated 5.0 by Business Owners across Australia

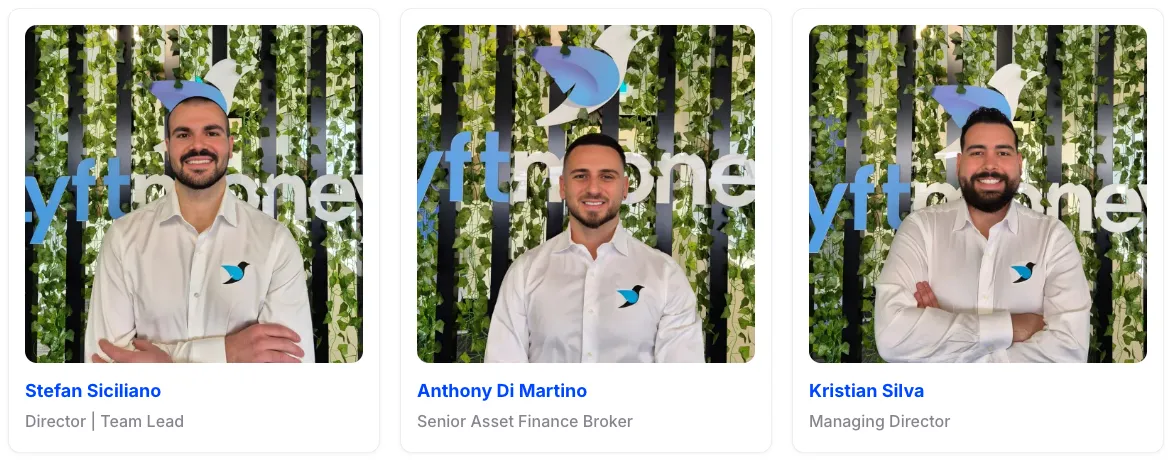

You Deal with Real People

Every loan is handled by a real specialist - no offshore call centre, no bots, no dealership pressure.

Compare 40+ lenders. Fast turnaround. No tacky sales.

WHAT YOU GET WITH LYFT MONEY

Everything You Need to Finance Vehicles and Equipment — Without the Delays, Stress or Guesswork

We’ve helped over 1,200+ Australian Businesses secure fast vehicle & equipment finance.

Here’s exactly what you get when you choose Lyft Money:

Fast Approvals in 24–48 Hours

We compare 40+ commercial lenders to get your business the best rate, with zero dealership markups or pushy salespeople.

Business-Ready Finance Options

Chattel Mortgage, Hire Purchase, Lease, Asset Lines — we match you with the right product for your business structure, cashflow, and tax position.

Funding for Vehicles and Equipment

Work vehicles, utes, vans, trucks, excavators, trailers, forklifts, machinery — if your business needs it to operate or grow, we can finance it.

Low-Doc & No-Doc Loan Options

We work with lenders that offer low-doc and no-doc approvals, meaning you can get funding with no financials or Bank Statements

Private Sale Safety Checks (If Buying Used)

PPSR, payout checks, ID verification and seller legitimacy checks — all handled securely to protect your business

Support From Start to Settlement

We handle all lender paperwork

PPSR checks on equipment or vehicles

Settlement coordination with sellers or suppliers

Everything done for you — so you stay focused on running your business.

Frequently Asked Questions

Here's what we usually get asked

Does filling in your form hurt my credit score?

No filling in our online form, getting pre-approval or a quote only uses a soft check.

What documents do I need?

Typically: ID (driver’s licence, medicare), proof of income (payslips or bank statements)

Do I need a deposit?

Not always. No-deposit car finance is common, though a deposit reduces your repayments and interest.

Can I get finance with bad credit?

Yes. Bad credit car loans are available, though rates may be higher or require a deposit. Lenders focus on your current ability to repay.

Who can apply for vehicle or equipment finance in Australia?

You must be 18+, an Australian citizen or resident, with a regular income.

How long does approval take?

Most of car loans are approved Same Day if documents are ready.

What interest rate will I pay?

Car loan rates in Australia vary from ~5% for strong applicants to 10%+ for higher risk. Used vehicles may attract slightly higher rates.

Can I pay my vehicle or equipment loan off early?

Often yes. Some lenders charge an early payout fee, but others allow extra repayments with no penalty.

Are repayments fixed or variable?

Most asset loans are fixed, meaning your repayment doesn’t change. Variable loans exist but are less common.

Do I own the vehicle or equipment under finance?

Yes, your name is on the rego. The lender only holds a security interest until the loan is repaid.

Can I get finance without full financials?

Yes. Low-doc loans are available for self-employed or startups using BAS, bank statements or accountant letters.

What happens at the end of my loan?

With no balloon – you own the asset outright. With a balloon – you can pay, refinance, or trade in your car to cover it.

Can I sell or trade-in during the loan?

Yes. The loan must be paid out first though.

What’s the benefit of pre-approval?

Asset loan pre-approvals give you a clear budget and bargaining power when shopping. It makes buying faster and reduces reliance on dealer finance.

Dealer finance vs broker or bank – what’s best?

Dealers are convenient but may add hidden costs. Banks are straightforward but rigid. Brokers like Lyft Money compare multiple lenders to find you the most competitive car loan in Australia.

How does vehicle or equipment finance work?

A lender pays for your asset upfront and you repay in set instalments (weekly, fortnightly or monthly). With a secured vehicle or equipment loan, you own the asset while the lender holds it as security.

Can I finance a used car, ute or truck or equipment?

Yes. Most lenders in Australia offer used car, truck and equipment loans, often up to 12–15 years old. Rates may be slightly higher than new vehicles, but finance is available.

Why finance instead of paying cash?

Finance spreads the cost, preserves savings, and lets you get on the road sooner. You’ll pay interest, but repayments are fixed and predictable.

What’s the difference between secured and unsecured loans?

A secured car loan uses the vehicle as security, giving you a lower rate. Unsecured loans don’t use the car as collateral, but come with higher interest.